What is the Saint Matthew's Fund?

Saint Matthew's Fund (SMF) is a yearly fundraising initiative that provides vital support to the Saint Matthew's Episcopal School operating budget. We are an independent school that relies on the generosity of its constituents. Thanks to the support of our school community, SMES has been able to shape and expand our excellent academic programs, recruit and retain quality faculty and staff, stay ahead of the curve on technology in education, and develop a unique learning environment.

How can you help?

Any size gift is appreciated. Gifts to SMF allow the school to start new programs and strengthen current ones. Your gift also helps assure that we can maintain or exceed our enrichment programs, professional development, technology improvements, and purchase new curriculum. Participation by the entire SMES Family is key to our continued success. We invite you to get involved and share with your family members. Gifts can be a one-time donation or a monthly pledge. All gifts to the school are deductible for federal income tax purposes.

The impact of a gift: No matter how small the donation, it makes an impact. Below are examples of how your donation can help our budget.

Cost to run the school: Running a school comes with many expenses. These expenses include:

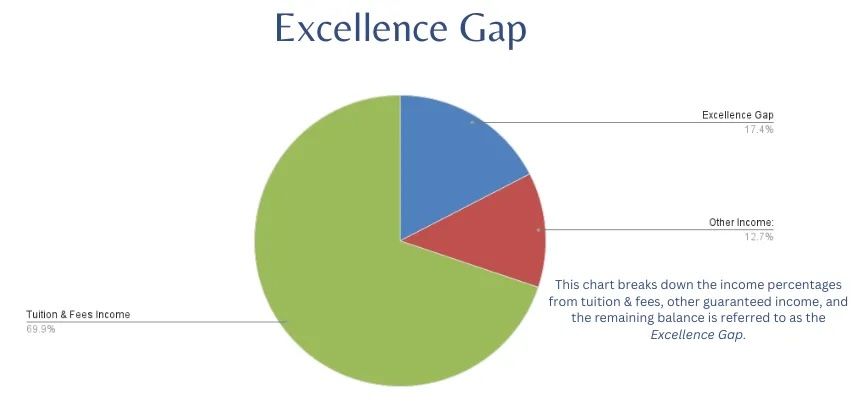

Excellence Gap: What is the Excellence Gap?

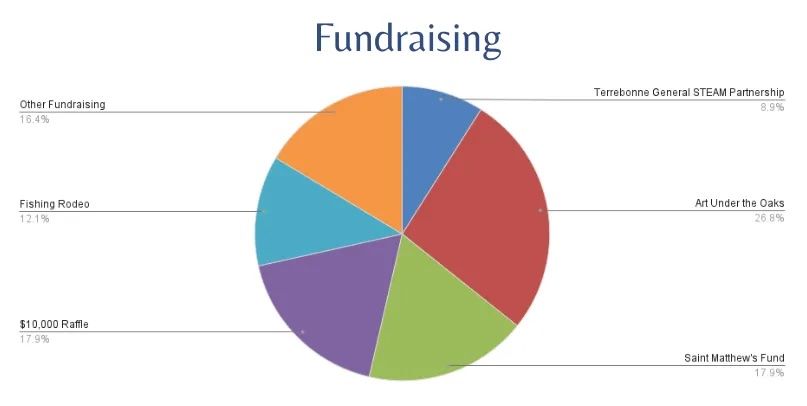

The Excellence Gap is defined as the amount of budgeted expenses that are not covered by tuition, fees, and “other income.” Other income is defined as income from our auxiliary programs such as hot lunch and extended care. All other operating expenses are covered by our Fundraising Initiatives.

Why is it important to cover the Excellence Gap? This year, the school expects to spend approximately $1,500 more educating each student than a family pays in tuition. Covering the excellence gap is the best way to prevent increases in tuition, while continuing to educate our children by nurturing the mind, heart, and soul in a Christian Environment.

Saint Matthew's Fund (SMF) is a yearly fundraising initiative that provides vital support to the Saint Matthew's Episcopal School operating budget. We are an independent school that relies on the generosity of its constituents. Thanks to the support of our school community, SMES has been able to shape and expand our excellent academic programs, recruit and retain quality faculty and staff, stay ahead of the curve on technology in education, and develop a unique learning environment.

How can you help?

Any size gift is appreciated. Gifts to SMF allow the school to start new programs and strengthen current ones. Your gift also helps assure that we can maintain or exceed our enrichment programs, professional development, technology improvements, and purchase new curriculum. Participation by the entire SMES Family is key to our continued success. We invite you to get involved and share with your family members. Gifts can be a one-time donation or a monthly pledge. All gifts to the school are deductible for federal income tax purposes.

The impact of a gift: No matter how small the donation, it makes an impact. Below are examples of how your donation can help our budget.

- A $10 gift will cover a Reading Eggs subscription for one student.

- A $20 gift will cover the fuel needed for the grass to be cut.

- A $100 gift will cover a Moby Max (math) subscription for one class.

- A $500 gift will cover one month of Kentwood Water that is provided throughout our campus.

Cost to run the school: Running a school comes with many expenses. These expenses include:

- Average electricity bill per month: $3,089.89

- Internet expense per year: $2,280

- Trash removal per year: Approximately $6,800

Excellence Gap: What is the Excellence Gap?

The Excellence Gap is defined as the amount of budgeted expenses that are not covered by tuition, fees, and “other income.” Other income is defined as income from our auxiliary programs such as hot lunch and extended care. All other operating expenses are covered by our Fundraising Initiatives.

Why is it important to cover the Excellence Gap? This year, the school expects to spend approximately $1,500 more educating each student than a family pays in tuition. Covering the excellence gap is the best way to prevent increases in tuition, while continuing to educate our children by nurturing the mind, heart, and soul in a Christian Environment.